Last Thursday, the Jobless Claims number jumped to 406,000 new claims from the week's previous claims number of 372,000 (See Full Story). This was an unexpected jump and, it was one of the reasons, besides the decline in existing home sales, that caused the stock market to tumble almost 300 points for the Dow Industrial Average. On that very same day, the minimum wage was automatically set, by law, to increase from $5.85 an hour to $6.55.

Last Thursday, the Jobless Claims number jumped to 406,000 new claims from the week's previous claims number of 372,000 (See Full Story). This was an unexpected jump and, it was one of the reasons, besides the decline in existing home sales, that caused the stock market to tumble almost 300 points for the Dow Industrial Average. On that very same day, the minimum wage was automatically set, by law, to increase from $5.85 an hour to $6.55.As far as I know, no one seems to have put together the new minimum wage rate and the rather unexpected increase in the job's claims that we saw last Thursday. While I have no proof of this, I think that there might be a correlation between the two. Think about it. We are in the midst of an extremely weak economy. Knowing this and knowing that they will be forced to give "unearned" raises to some of their "least senior" employees (and, maybe forcing all other employees to get an unearned, but equalizing, wage increase), isn't it possibile that some employers were actually forced to let people go in order to avoid paying the higher minimum wage? It has been proven, through study after study, that job losses occur as a result of increasing the minimum wage . Just look at this report from 1996 that, I believe, swayed Bill Clinton in deciding to let the individual States determine their own minimum wage levels (See Full Story). If, in the next two or three weeks of jobless claims reports, we see a greater-than-expect drop in the new unemployment claims for that previous week, I think that this would be evidence that jobs were actually lost to the new level of the minimum wage.

I have always been against the Federal minimum wage.

First, it is almost exclusively used by the Democrats as a maneuver to satisfy their political base of both unions and independent low income labor. But, mostly the unions. A lot of people are unaware that many union contracts have clauses that force an automatic wage adjustment whenever the minimum wage is increased.

Second, an increase in the minimum wage can easily be across-the-board wage inflationary. Typically, the Federal minimum wage only affects those entry level positions in any business. When the minimum wage increase occurs, the gap between the least senior and the next level of employee is either closed or can even be exceeded. To compensate for this, the employer must push all of his wages "up" from the bottom. This can be devastating to company who might be barely profitable before the minimum wage went into effect. That could result in tough economic choices; and, usually, jobs or benefits are cut and/or prices are raised. Even companies who are in good shape, economically, might have to raise prices or let people go. You and I eventually pay the price as a consumer for higher prices and as a taxpayer for the unemployment insurance.

Third, and most importantly, a living wage is different from one part of this country to another. It is even different within the urban and rural areas of the same State. What might be a minimum, living wage in rural Tennessee or Mississippi would be pure poverty in places like New York or San Francisco. That's why the minimum wage levels should be set by the individual States (and even cities) and not by the Federal Government. Bill Clinton was right on this.

You will never hear from a Democrat that raising the minimum wage would actually result in job loses. Just as you will never hear from those same politicians that the elimination of Welfare, in 1996, was a social benefit and not "the social disaster" that they had all predicted. When the Democrats raised the minimum wage this time around, they did it to satisfy one of their political bases: the labor unions. It certainly didn't help those low income, non-union employees that may have lost their jobs because of it.

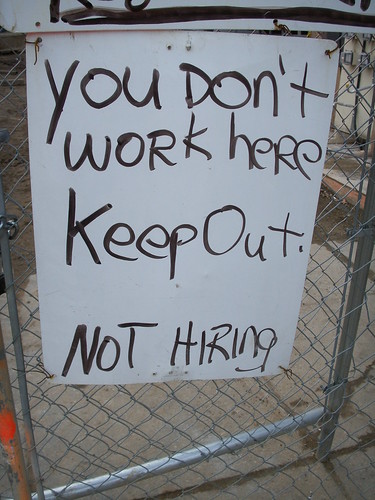

Image by Daquella manera's photostream on Flickr with Creative Commons Licensing (Click to View Other Works).

No comments:

Post a Comment